Mendocino County Faces Worsening Statewide Liability Climate, but Limited Local Data Show a Mixed Picture

A new law extending the statute of limitations for child sexual abuse is increasing premiums locally and statewide, but local workers comp claims are falling

Mendocino County’s risk manager warned supervisors this week that California’s liability environment is deteriorating rapidly, driving up insurance costs for public agencies statewide — but data presented alongside that warning showed the county has so far avoided the worst financial impacts.

“Everything is bad,” said Heather Correll Rose, summarizing trends that include rising lawsuit frequency, escalating jury awards, and a new acceptance of decades old claims of sexual abuse. Insurance markets across California are also shrinking.

Claims filed against public entities statewide have increased 23% over the past decade, Rose said, while so-called “nuclear verdicts” — awards exceeding $10 million — have become increasingly common. Although large claims of $1 million or more represent less than 1% of total filings, they represent roughly 61% of all taxpayer dollars paid out, she said.

Those pressures affect Mendocino County because it shares insurers with cities and counties throughout California, Rose told the Mendocino County Board of Supervisors during a two-day workshop to discuss 2026 priorities.

But while Rose emphasized that statewide conditions are worsening, the limited county-specific data presented by Rose painted a more nuanced picture.

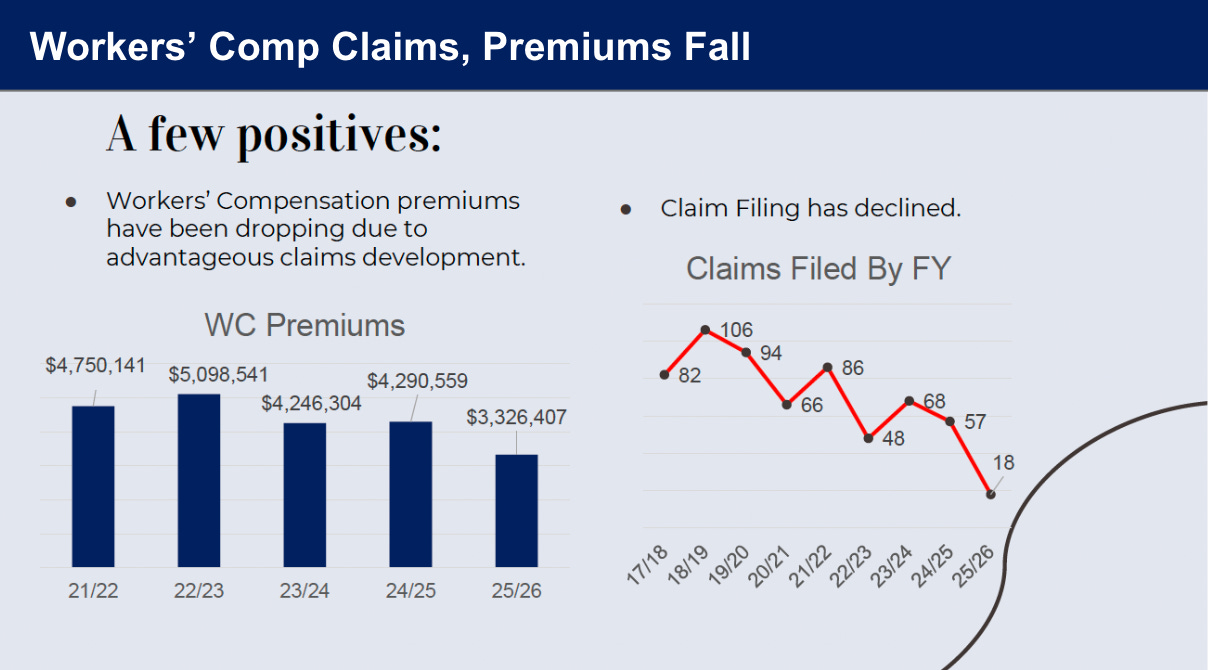

Workers’ compensation premiums for Mendocino County have declined “rather drastically,” she said, attributing the decrease to changes in claims handling and favorable claims development. New workers’ compensation claims so far this fiscal year are at a record low, she said, though she cautioned the year is only at its midpoint.

Liability claims also tend to unfold over long time horizons, Rose said, with cases often taking four to five years to resolve — and some lasting a decade. As a result, annual snapshots can exaggerate volatility, since insurance reimbursements typically arrive only after claims close.

Only about 45% of claims filed in 2023 and 2024 have been resolved, she said, meaning the county is still carrying costs that may later be reimbursed.

Much of the growing risk exposure, Rose said, stems from forces largely outside local control. Those include inflation in medical costs, increased litigation financing by outside investors, expanded liability tied to childhood sexual abuse claims under Assembly Bill 218, and escalating cyber threats targeting public agencies.

Los Angeles County alone has set aside $4 billion to settle AB 218 claims, Rose said — a figure she said reverberates across California’s insurance market. “ If you think that’s not going to impact the insurance market, boy is it,” she said.

The Los Angeles County Board of Supervisors approved the $4 billion settlement of nearly 7,000 claims of “horrific” sexual abuse last spring. The majority of the claims are alleged to have taken place at the MacLaren Children's Center and Probation Department facilities in the 1980s, 1990s, and 2000s, with the alleged abuse stretching back to 1959.

AB 218, also known as the California Child Victims Act, dramatically extended the statute of limitations for childhood sexual abuse cases and expanded the definition to childhood sexual assault. The law extended the filing deadline from age 26 to age 40 and created a five-year “discovery window” allowing plaintiffs to file suit within five years of discovering that a psychological injury suffered in adulthood was caused by childhood sexual assault.

The law also established a three-year “look back” period (Jan 1,2020 — December 31, 2022) for all past survivors to file claims, regardless of age or when the abuse occurred.

Older claims can be particularly difficult for public agencies to defend, Rose said “Folks don’t work here anymore,” she said. “You might have a lack of documentation.”

To reduce future risk exposure, Rose proposed several policy approaches, including expanded use of virtual meetings to to limit exposure to travel-related injuries, updates existing policies and procedures, and closer coordination with neighboring counties and public entities “to make sure we are handling sensitive matters consistently.”

Supervisor Ted Williams questioned whether rising risk costs could eventually outpace county revenue growth and force budget cuts elsewhere. Rose said the trend bears monitoring and that she is working daily with county department to reduce exposure.

“Prevention costs way less than response,” she said.